- #How to file extension for business tax return in nj how to

- #How to file extension for business tax return in nj download

#How to file extension for business tax return in nj how to

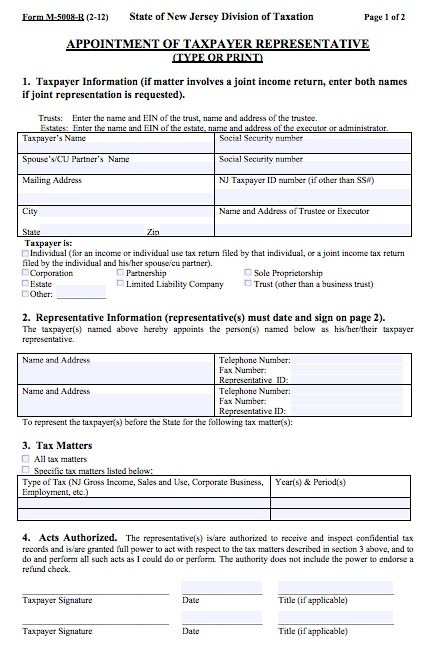

In order for New Jersey to accept your extension, you must: How to File a Corporate Income Tax Return. There are 3 ways to extend your tax return. You Must Pay At Least 80% of Your Tax Liability Learn how you can extend your tax return fast online or by paper and how you can make an extension payment. If You Are Not Filing a Federal Extensionįile Form NJ-630 to request an extension with New Jersey no later than April 18, 2022. Provide us with a copy of your federal extension application (or confirmation number from the IRS) when you file your New Jersey tax return.Ĭivil union partners filing a joint return must either provide copies of the federal extension application (or confirmation number), or they must file Form NJ-630. You will have until October 15, 2022, to file your New Jersey return.You must pay at least 80% of any owed taxes no later than April 18, 2022, to avoid a late filing penalty.There is no extension of time to pay your taxes.The additional extension of time to file is to Octo.For non-paid preparer returns, all partnerships with 10 or more partners are required to file electronically.If you need more time to prepare your tax return, beyond the due date of April 18, you may apply for an extension of time to file. Phone: 60 State electronic filing details Grace periodĪll paid preparer returns are required to be filed and paid electronically. Almost every state imposes a business or. Absent any business activity, you might be able to skip filing your federal LLC tax return. Instead, each partner reports their share of the partnerships profits or loss on their individual tax return. You must always file your LLC taxes when you have business activity: revenues, deductions, and credits. Partnerships, however, file an annual information return but dont pay income taxes. New Jersey Division of Revenue E-file Unit Attn: NJ-1065 PO Box 628 Trenton, NJ 08646-0628 Most businesses must file and pay federal taxes on any income earned or received during the year.

If an extension shows a balance due it must be paid by direct debit.

Yes, if filing more than 10 resident returns.Īct of e-file is considered signature. Phone: 60 or 60 Tax Refund Inquiries: 60 or 80 State electronic filing details Grace period The form comes with a list of addresses telling you where to send the form and your payment. If youve calculated that you probably owe tax, write a check for that amount and mail the extension form with your check. If You Are Not Filing a Federal Extension File Form NJ-630. Civil union partners filing a joint return must either provide copies of the federal extension application (or confirmation number), or they must file Form NJ-630. Individual Income Tax Return, from the IRS website. Provide us with a copy of your federal extension application (or confirmation number from the IRS) when you file your New Jersey tax return. Understandably, fiduciaries that are required to file this form may need additional time to complete this tax return. Know about Income Tax Audit & Presumptive Taxation for businesses & professionals.

#How to file extension for business tax return in nj download

If you have specific questions about what you can e-file or about rejections you received, contact the state for more information. Download Form 4868, the Application for Automatic Extension of Time to File U.S. One of the more complex and intimidating business income tax returns that is due for many filers on Apis the Form 1041 for trusts and estates. The article in general discusses types of business tax returns & filing.

0 kommentar(er)

0 kommentar(er)